Utility Shutoffs

Erase Past-Due Utility Balances with a Trusted Bankruptcy Attorney

Behind on Utility Bills? Bankruptcy Can Restore Your Power

Are you facing a utility shutoff or already living without gas, electricity, or water? If you’re overwhelmed by past-due utility bills and unable to catch up, you may be able to restore services and prevent future shutoffs with the help of bankruptcy.

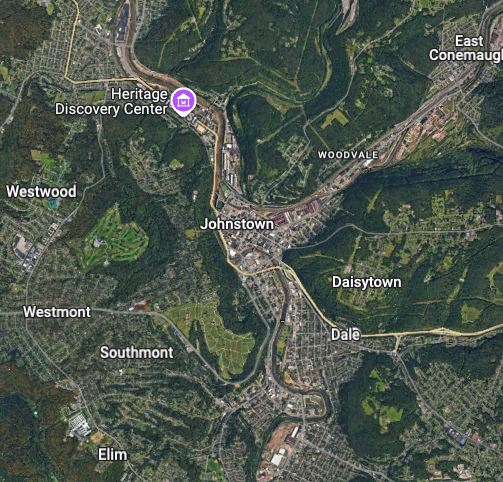

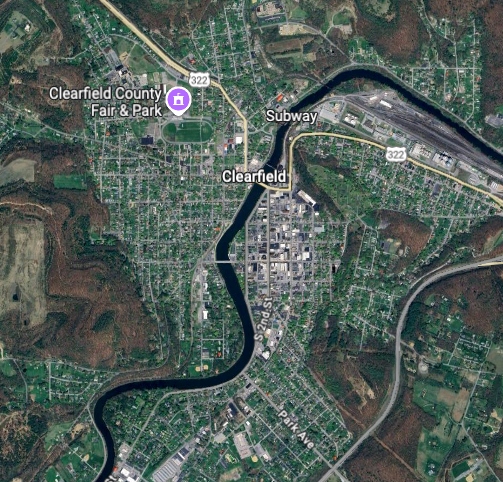

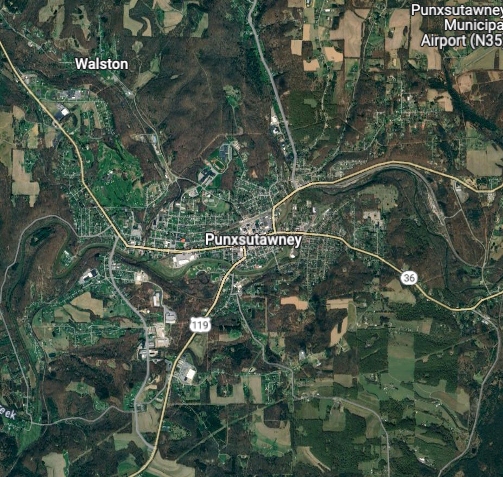

At The Debt Erasers, we help people across Johnstown, Clearfield, Punxsutawney, and Somerset, PA use Chapter 7 or Chapter 13 bankruptcy to stop utility shutoffs, erase old balances, and regain financial stability. Our experienced bankruptcy attorney is here to walk you through your options and fight for the fresh start you deserve.

No Pressure - Just Answers

How Bankruptcy Stops Utility Shutoffs In Pennsylvania

When you file for bankruptcy—whether Chapter 7 or Chapter 13—you’re immediately protected by something called the automatic stay. This is a legal order that forces all creditors, including utility companies, to stop collection activity and service disconnections.

That means:

- Your electricity, gas, or water cannot be shut off

- If services have already been disconnected, the utility company may be required to restore service

- Your past-due balance can be included in your bankruptcy case, potentially erasing the debt

Whether you’ve received a shutoff notice or your utilities have already been cut, bankruptcy may provide a fast and effective solution.

What Utility Bills Can Be Included In Bankruptcy?

Chapter 7 vs. Chapter 13 for Utility Debt

What Happens If Utilities Are Already Shut Off?

Why Choose The Debt Erasers?

Help Is Closer Than You Think

Johnstown Office

319 Washington Street, Suite 238

Johnstown, PA 15901

814-536-7470

Clearfield Office

301 E. Pine Street

Clearfield, PA 16830

814-765-2699

Somerset Office

118 South Kimberly Street, Suite 30

Somerset, PA 15501

814-536-7470

Punxsutawney Office

103 North Gilpin Street, Suite 307

Punxsutawney, PA 15767

814-765-2699

Contact Us About Your Case

Ready to take the first step toward a fresh financial start? Contact The Debt Erasers today to schedule your free consultation. We’ll listen to your situation, answer your questions, and help you build a clear, personalized gameplan for debt relief through Chapter 7 or Chapter 13 bankruptcy. There’s no pressure—just honest guidance from a team that truly cares.