Student Loan Debt

Student Loan Debt Relief Through Bankruptcy

Student Loan Debt Attorney Serving Western & Central Pennsylvania

If you’re overwhelmed by student loan debt and constant collection efforts, you’re not alone—and you’re not stuck. At The Debt Erasers, we help individuals and families across Western and Central Pennsylvania use Chapter 13 bankruptcy to pause student loan payments, stop aggressive collections, and take back control of their finances.

Whether your bank account was frozen, your tax return was seized, or the collection calls won’t stop, bankruptcy may offer the breathing room you need to reset your financial life.

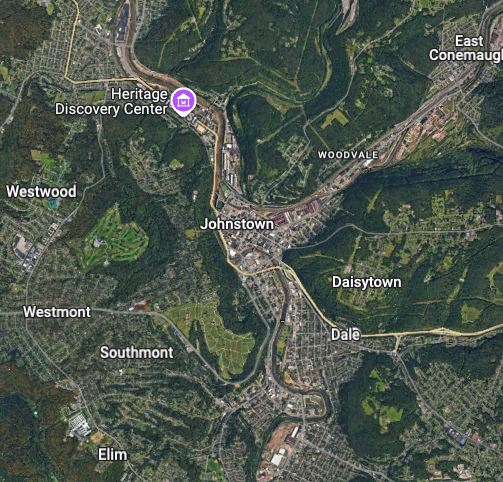

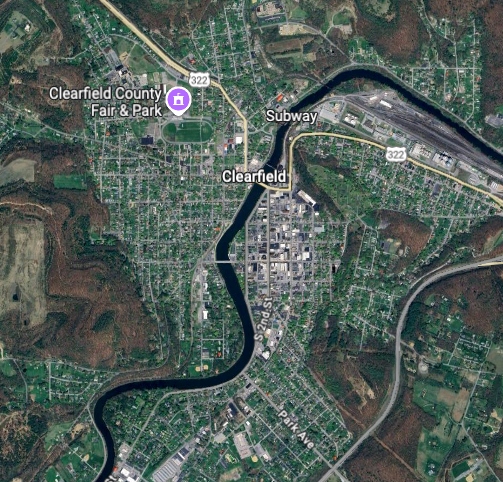

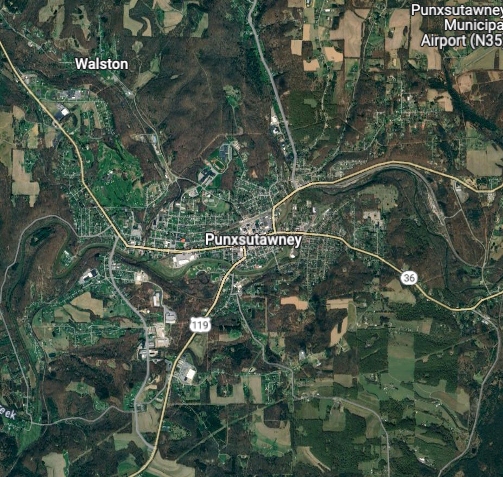

Serving Johnstown, Clearfield, Punxsutawney, Somerset & Nearby PA Areas

No Pressure - Just Answers

Can Bankruptcy Help With Student Loans?

It’s true that most student loans aren’t wiped out in bankruptcy—but that doesn’t mean bankruptcy can’t help. Filing for Chapter 13 gives you legal protection from collection activity, and can offer three to five years of relief from required payments. During that time, you can focus on catching up on other debt, rebuilding savings, and regaining your financial stability.

Chapter 13 Bankruptcy can:

-

Stop wage garnishment and bank levies

-

Block the seizure of tax refunds

-

Pause federal and private student loan payments for 3–5 years

-

Give you space to catch up on mortgage, car loans, or credit cards

-

Help you avoid judgments and liens

Even if the loans aren’t forgiven, the breathing room can make a massive difference. You’re able to reset without losing everything you’ve worked for.

What Happens After The Bankruptcy Plan?

If Your Bank Account Or Tax Return Was Taken…

What About Private Student Loans?

Why Choose The Debt Erasers?

Help Is Closer Than You Think

Johnstown Office

319 Washington Street, Suite 238

Johnstown, PA 15901

814-536-7470

Clearfield Office

301 E. Pine Street

Clearfield, PA 16830

814-765-2699

Somerset Office

118 South Kimberly Street, Suite 30

Somerset, PA 15501

814-536-7470

Punxsutawney Office

103 North Gilpin Street, Suite 307

Punxsutawney, PA 15767

814-765-2699

Contact Us About Your Case

Ready to take the first step toward a fresh financial start? Contact The Debt Erasers today to schedule your free consultation. We’ll listen to your situation, answer your questions, and help you build a clear, personalized gameplan for debt relief through Chapter 7 or Chapter 13 bankruptcy. There’s no pressure—just honest guidance from a team that truly cares.