Judgments

Get Out From Under A Judgment – We Can Help

Erase Court Judgments & Debt with a Bankruptcy Attorney Near You

Have you been hit with a judgment? Is your paycheck being garnished or your bank account frozen? I know how overwhelming that can feel—but I want you to know you’re not out of options.

At The Debt Erasers, we help people all across Western and Central Pennsylvania get protection from judgments and collection efforts through Chapter 7 or Chapter 13 bankruptcy. I’m Attorney Kenneth P. Seitz, and I’ve been guiding individuals and families through this process for over 20 years. Together, we can build a plan to stop the garnishments, protect your property, and erase the debt behind the judgment—so you can move forward with peace of mind.

No Pressure - Just Answers

What Is A Judgment, And Why Does It Matter?

A judgment is a court order confirming that you owe a debt. In Pennsylvania, judgments come with some serious consequences:

-

They’re good for five years and can be renewed again and again.

-

They automatically attach to any real estate you own in the county.

-

They can lead to wage garnishment or bank account seizures.

-

They can prevent you from selling or refinancing your home.

Judgments don’t just go away on their own—but bankruptcy can give you a powerful tool to stop the damage.

How Bankruptcy Can Help With Judgments

Chapter 7 vs. Chapter 13: Which Is Right For You?

Why Choose The Debt Erasers?

Help Is Closer Than You Think

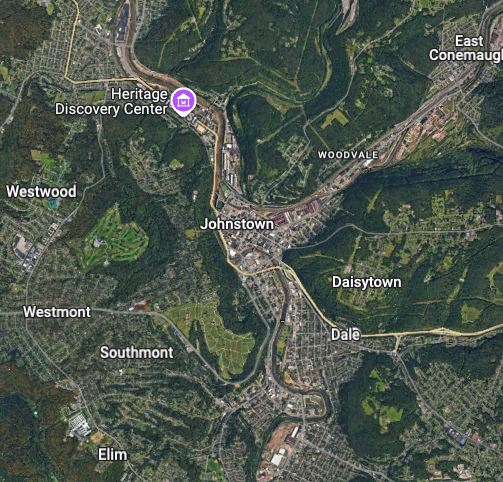

Johnstown Office

319 Washington Street, Suite 238

Johnstown, PA 15901

814-536-7470

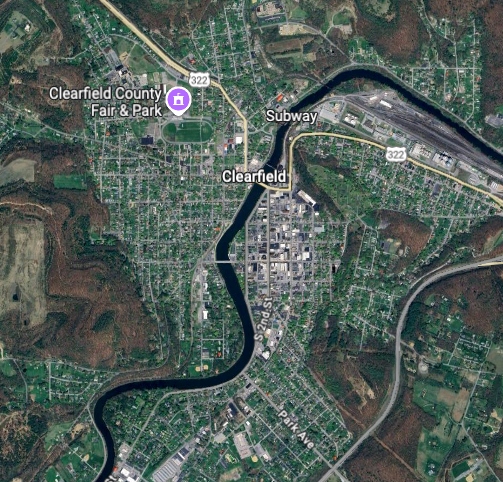

Clearfield Office

301 E. Pine Street

Clearfield, PA 16830

814-765-2699

Somerset Office

118 South Kimberly Street, Suite 30

Somerset, PA 15501

814-536-7470

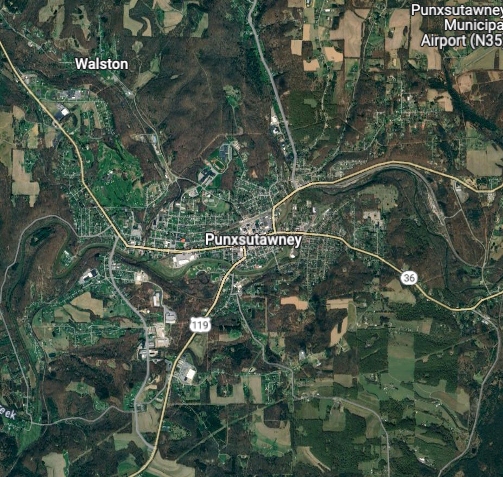

Punxsutawney Office

103 North Gilpin Street, Suite 307

Punxsutawney, PA 15767

814-765-2699

Contact Us About Your Case

Ready to take the first step toward a fresh financial start? Contact The Debt Erasers today to schedule your free consultation. We’ll listen to your situation, answer your questions, and help you build a clear, personalized gameplan for debt relief through Chapter 7 or Chapter 13 bankruptcy. There’s no pressure—just honest guidance from a team that truly cares.