Repossessions

Stop Vehicle Repossession With Bankruptcy

Real Solutions for Repossession and Auto Loan Debt in Western Pennsylvania

If you’ve fallen behind on your car loan payments and are worried your vehicle may be repossessed—or already has been—you’re not out of options. At The Debt Erasers, we help individuals and families in Johnstown, PA, and surrounding areas stop repossessions and regain control of their vehicles through the power of Chapter 13 bankruptcy.

Our experienced bankruptcy attorney can guide you through a legal process that not only stops repossession in its tracks but also lowers your monthly payment and gives you a realistic way to catch up on what you owe—so you can move forward without fear.

No Pressure - Just Answers

How Bankruptcy Stops Repossession

When you file Chapter 13 bankruptcy, it immediately activates an automatic stay—a legal order that prevents your lender from repossessing your vehicle or continuing collection efforts. Even if your car is already scheduled for repossession, this stay can stop it from happening.

Better yet, Chapter 13 doesn’t just delay the problem—it gives you a solution.

With a Chapter 13 repayment plan, you can:

- Cure your arrears (missed payments) over 3–5 years

- Lower your monthly car payment

- Reduce your interest rate

- Keep your car and catch up without penalties or late fees

Example: Restructuring Your Auto Loan in Bankruptcy

Let’s say you owe $10,000 on a vehicle and are struggling to make payments. Through a Chapter 13 Plan, you may be able to restructure that loan so that your new monthly payment is only around $180, depending on the terms of your repayment plan.

This type of restructuring makes it possible for you to keep your vehicle without overextending your budget, all under the protection of the bankruptcy court.

What If My Vehicle Has Already Been Repossessed?

Who Can Benefit From Chapter 13 Bankruptcy?

Help Is Closer Than You Think

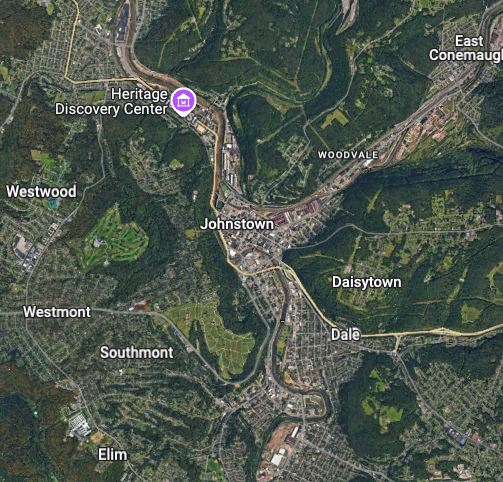

Johnstown Office

319 Washington Street, Suite 238

Johnstown, PA 15901

814-536-7470

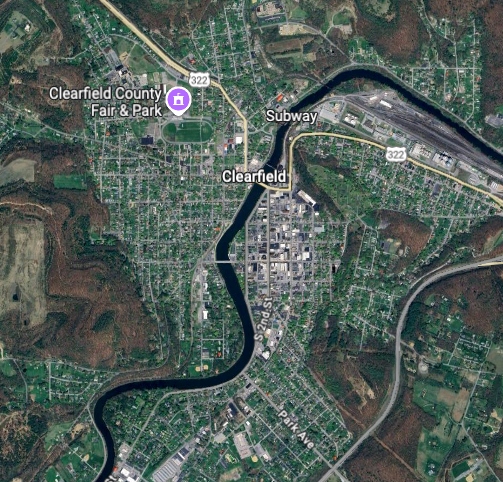

Clearfield Office

301 E. Pine Street

Clearfield, PA 16830

814-765-2699

Somerset Office

118 South Kimberly Street, Suite 30

Somerset, PA 15501

814-536-7470

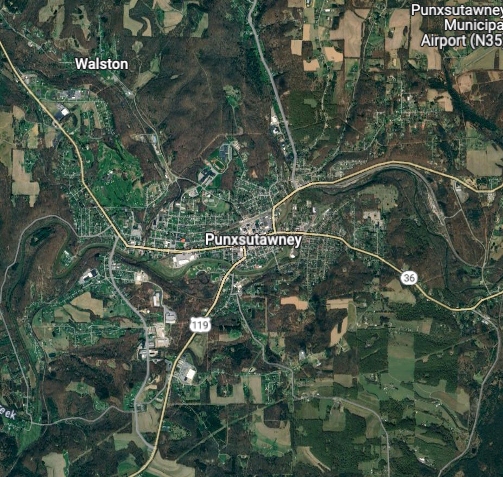

Punxsutawney Office

103 North Gilpin Street, Suite 307

Punxsutawney, PA 15767

814-765-2699

Contact Us About Your Case

Ready to take the first step toward a fresh financial start? Contact The Debt Erasers today to schedule your free consultation. We’ll listen to your situation, answer your questions, and help you build a clear, personalized gameplan for debt relief through Chapter 7 or Chapter 13 bankruptcy. There’s no pressure—just honest guidance from a team that truly cares.